Is Donald Trump trying to bankrupt the global economy?

I’m not trying to be smart here. It’s a fair question to ask.

On April 2nd, in the White House Rose Garden, the president declared it “Liberation Day.” But for many economists, it might as well have been “Recession Eve.” The tariffs he unveiled that day were not a subtle jab at China or a tactical pressure campaign. They were, in many ways, a sledgehammer to the face of global trade. A 10% tariff on all imports. Higher rates on select “bad actors” like China, India, Vietnam, and the EU. The result: a projected effective U.S. tariff rate of nearly 24%—the highest in 125 years.

Enjoy independent, ad-free journalism - delivered to your inbox each week

You could be forgiven for wondering whether Trump understands how tariffs actually work.

He’s pitched them as a Swiss Army knife for nearly every economic and societal ill, from creating more jobs at home to combating the fentanyl crisis and addressing illegal immigration. The president has promised to reduce consumer prices, despite increasing the cost of nearly everything imported. This is not serious policy; it’s more like magical thinking.

Again, I am not trying to be smart. However, objective reality deserves to be acknowledged openly and honestly.

It’s important to be very clear here: tariffs are a tax. They aren’t paid by China; they are paid by American companies and consumers. When a manufacturer imports machinery from Germany or a retailer orders electronics from South Korea, they pay more. That cost doesn’t get absorbed; instead, it gets passed down. Specifically, it gets passed down to stores, buyers, and families already reeling from inflation (because of the tariffs, the average American household should now expect to pay an extra $2,100 a year for goods).

Many fear that Trump’s trade war with tariffs could trigger a global economic collapse, raising costs for consumers and businesses, and harming global trade.

Trump’s economic team argues that this pain is temporary and that it will all be worth it once American industry bounces back. But even if that scenario played out, it wouldn’t happen overnight. Building factories takes time. Reshoring production lines takes years, even decades. And that assumes companies want to return. Many don’t.

In the short term, prices rise. Wages stagnate. Consumer demand falls. Layoffs begin. That’s not theory. That’s a recipe for recession. And when the U.S. sneezes, as clichéd as it sounds, the world catches a cold.

In the short term, prices rise. Wages stagnate. Consumer demand falls. Layoffs begin. That’s not theory. That’s a recipe for recession. And when the U.S. sneezes, as clichéd as it sounds, the world catches a cold.

The European Union (EU) is already promising retaliatory tariffs. The UK is weighing its options. Canada and Mexico won’t be far behind. This is how trade wars start, not with coordinated diplomacy but with mutual punishment—tit for tat. The first casualties will likely be American exporters and workers, including beef farmers, car manufacturers, aviation suppliers, and others. Industries that depend on open markets will suddenly find themselves constrained by new tariffs on the other end.

Trump says this is about strength. But even the most hardcore MAGA enthusiast is entitled to think otherwise.

Real strength, I suggest, doesn’t involve lighting the world economy on fire and pretending it’s a barbecue.

Trade wars begin with retaliation, not diplomacy—U.S. exporters like farmers and carmakers may be the first to suffer from global tariff backlash.

Even if the president walks it all back tomorrow, the damage is done. Markets hate unpredictability. Investment freezes. Hiring slows. Small businesses panic. Big businesses hoard cash. Confidence—arguably the most important economic factor—evaporates. And when confidence vanishes, so does growth.

To be clear, the idea of re-industrializing America isn’t wrong. The U.S. should be securing supply chains. Its leaders should invest in infrastructure, rare earth mining, chip fabrication, and advanced manufacturing. But that takes strategy. Partnerships, and pragmatic planning. Not one-size-fits-all tariffs that crush America’s allies and disrupt domestic industry.

Even the math doesn’t add up.

Trump claims tariffs will fund tax cuts and pay down the debt. But Yale’s Budget Lab estimates they might generate $2.5 trillion over a decade — and that’s if they don’t tank the economy entirely. His proposed tax cuts total more than $4 trillion, creating a $1.5 trillion shortfall even before accounting for the damage tariffs inflict on growth, investment, and jobs.

Tariffs play well in swing states. They sound tough and make for easy applause lines at rallies in Wyoming and West Virginia; they create a powerful impression of action. A master of symbolism, Trump understands that placing a “Made in America” label on a questionable policy can be persuasive. However, economic policy is not defined by slogans. Ultimately, it lives and dies by its consequences–and the consequences of the latest tariffs could be rather severe.

Already, global financial markets are wobbling. Oil prices are surging. Bond yields are reacting. Foreign governments are scrambling to assess their options. A global trade slowdown could send emerging economies into Icarus-like tailspins. It could trigger currency crises, default cascades, and geopolitical instability—exactly the kind of global chaos America is supposed to help prevent, not ignite.

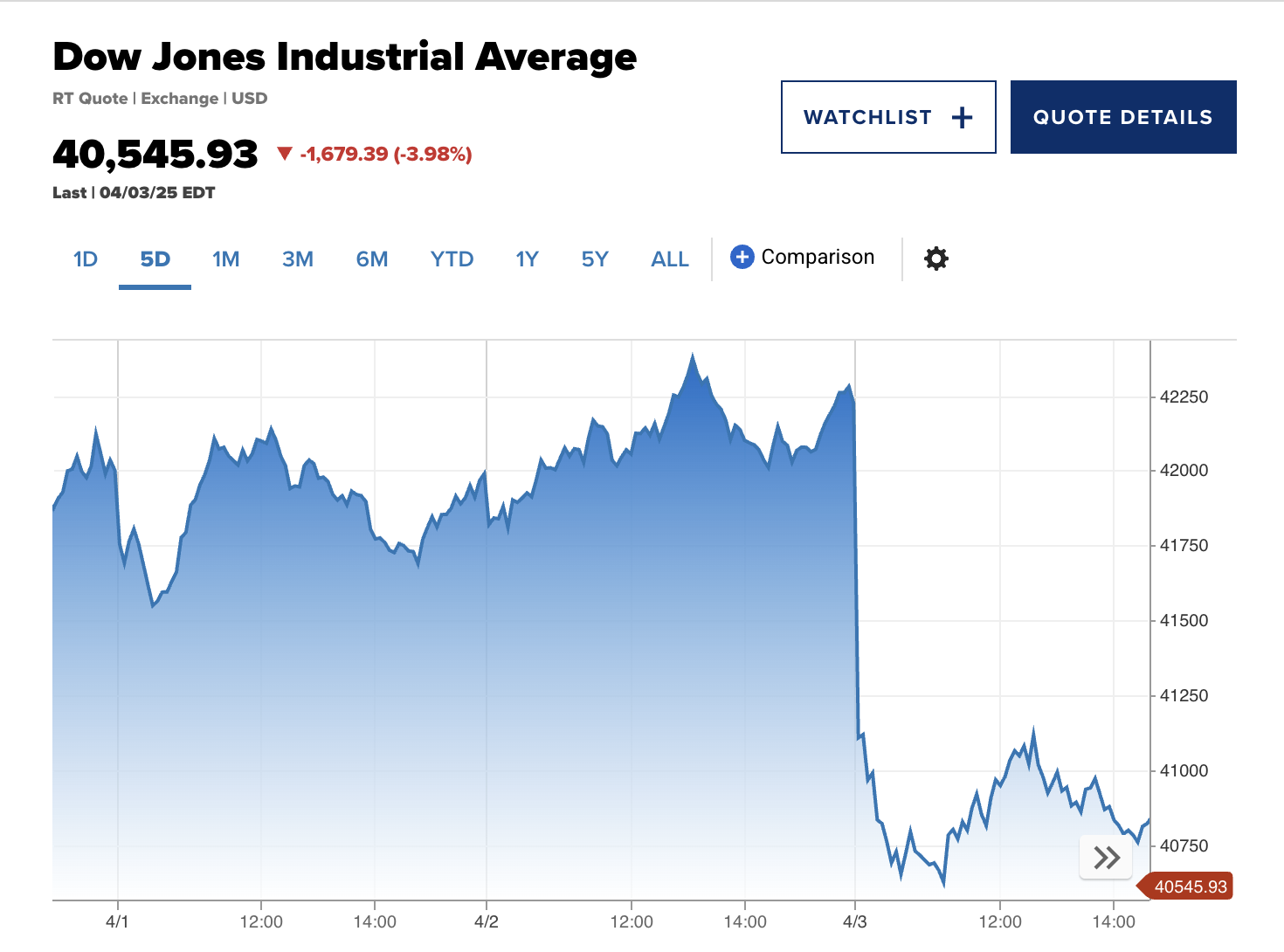

Markets have tanked as Trump’s tariffs were announced, with Dow diving nearly 4% amid investor uncertainty.

Of course, it doesn’t have to be this way. In truth, it needn’t be this way.

If the president is serious about re-shoring jobs and rebuilding the American economy, which I believe he truly is at heart, he has several tools available. These include tax incentives for domestic manufacturing, federal investment in innovation, strategic public-private partnerships, vocational education, and targeted regulations that prioritize long-term planning over quarterly profits.

Tariffs are akin to drone strikes: They can be effective, but only when employed precisely, sparingly, and by well-trained experts. Broad, sweeping tariffs without a coherent plan risk impacting everything and resolving nothing.

This brings us back to the initial question: Is President Trump trying to bankrupt the global economy? No, not intentionally. However, if intent matters less than impact, the end result may be the same.

Comments (1)

Only supporting or founding members can comment on our articles.